Market Watch

May 1, 2024

European demand for used BEVs improves while average used car prices continue to fall reports INDICATA

All powertrains improved their sales rate in April, according to our Market Days’ Supply metric which measures available stock against the current daily sales run rate.

INDICATA’s Market Watch report saw diesel remain as the top performer, with an MDS of 57 days, while petrol’s MDS of 60 days demonstrated that traditional powertrains remain the most in-demand compared to available stock.

With PHEV/HEV at 70 days and MHEV at 71 days, the other notable April result is BEV’s MDS of 97 days which is a significant improvement on the 129 days for BEVs at the start of February, it underlines the imbalance between supply and demand in Europe.

Higher demand for youngers BEVs

BEVs accounted for 4.76% of the April online B2C used vehicle market, but they comprised 7.48% of the available stock. Whilst there is more demand for used BEVs at the younger end of the market, accounting for 7.86% of the market for used cars up to four years old, they are 11.37% of available stock, which adds further downward pricing pressure.

The online B2C market for used passenger cars up to four years old showed a similar pattern, with diesel at 60 days and petrol at 63 days. MHEV and PHEV/HEV were both at 71 days, while BEVs were at 96 days.

Average used prices continue to fall

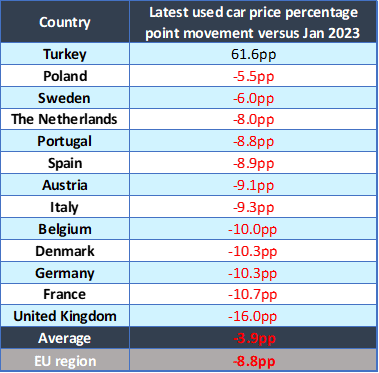

When reviewing prices all LHD markets except for Turkey experienced a further drop in average prices. The average prices for these markets fell by 0.5 pp by the start of May, leaving them 8.8 points lower than at the beginning of 2023.

Denmark saw the most significant monthly drop in average prices as they fell 0.95 points in the month, down to 10.3 points, closely followed by Austria, where average prices dropped 0.89 points MoM. Portugal saw the lowest monthly decline in average prices, dropping just 0.12 points, with Belgium dropping 0.29 points MoM.

France and the UK see the highest fall

Across the LHD markets, France has seen the highest price fall since the start of 2023, down 10.7 points over that period. Germany and Denmark saw prices at the beginning of May 2024 10.3 points lower than in January 2023, with Belgium the only other LHD market with a double-digit reduction over that period, 10.0 pp.

The UK saw average prices drop by a further 0.71 points month-on-month going into May, leaving the UK at 16.0 percentage points lower than at the start of 2023.